Info Sheets

What Happens When a Married Couple Who Has Filed Chapter 13 Bankruptcy Separates?

Married couples frequently file a bankruptcy case together in what is called a joint case. The Chapter 13 term lasts three to five years. Sometimes the couple’s relationship falls apart during that term. This article discusses three options that an attorney would discuss with the couple.

+ Read more

Bankruptcy Court Slams NetCredit for Violating Debtors’ Rights

Bankruptcy Court: NetCredit’s conduct “constitutes a reckless disregard of [its] statutory duties in arrogant defiance of federal law.”

In each of three separate Chapter 13 bankruptcy cases co-counseled by Boleman Law Firm, P.C., Consumer Litigation Associates, and the Law Offices of Dale W. Pittman, the Bankruptcy Court ordered NetCredit to pay $100,000 in punitive damages for egregious violations of the automatic stay. Each $100,000 award included payment of $37,500.00 to National Consumer Law Center (NCLC) and $37,500.00 to Legal Services Corporation of Virginia.

+ Read more

What if I Need a New Car During my Chapter 13 Bankruptcy?

Many clients wonder what will happen if their current vehicle breaks down or is a total loss during the term of their Chapter 13 Plan. While it is preferable to pay cash for a new vehicle, expenses in our lives do not always allow for this. The bankruptcy does not prohibit you from incurring debt but the process does require patience. We will discuss all your options with you prior to you making a decision.

+ Read more

Surprising Information About Your Credit

Credit reporting can be confusing. Quite often, what seems like “common knowledge” or “common sense” is, well, wrong. Many of the truths behind credit reporting may surprise you.

+ Read more

Do you have equity in Real Estate? We will help you!

One of the biggest myths I hear from people regarding bankruptcy is that they cannot file bankruptcy because the Trustee will take their home.

+ Read more

Bankruptcy and Bumps in the Road of Life

All people experience “bumps in the road” of life, such as job loss, illness, or death. If you experience such an event during your Chapter 13 bankruptcy, you should first inform your attorney. Every person’s circumstances are different, and your attorney will help you choose the option that best fits with your case and your goals.

+ Read more

Pro Se Debtors: Deficiencies, Inefficiencies, and Possible Solutions

By Amanda DeBerry Koehn and Angela Haen ¹

From a debtor’s perspective, filing bankruptcy is an expensive proposition. In addition to the court filing fee and mandatory credit counseling course, there is the cost of an attorney to represent them throughout the process.

+ Read more

Divorce and Bankruptcy: What are my options?

Folks often schedule a free consultation with us on the recommendation of their divorce attorney. Oftentimes, financial difficulties and divorce go hand-in-hand.

+ Read more

Bankruptcy filers’ biggest regret: “I should have done this sooner”

We have been privileged to help thousands of Virginians regain their financial health. But the most consistent regret these folks express to us is that they wish they had come to us for help sooner.

+ Read more

Qualifying for an apartment while in bankruptcy

Our clients are often concerned about renting an apartment after their bankruptcy case is filed.

+ Read more

Chapter Choice: Risk of incurring new debts after the filing of your bankruptcy.

Deciding which type of bankruptcy to file can be complicated. It is important to understand how the different types of bankruptcy will address the debts that you have.

+ Read more

When Things Don’t Go According to the Plan

Rule 3002.1: A Case Odyssey ¹

Federal Rule of Bankruptcy Procedure 3002.1 was intended to address communication problems regarding mortgage companies and Chapter 13 debtors, and the rule furthers its goal of increased transparency in two ways.

+ Read more

Bankruptcy versus Foreclosure or Short Sale

Negotiating with your lender may help you to avoid foreclosure on your home. If negotiating is not an option, filing bankruptcy may be the next option before foreclosure.

+ Read more

Bank Accounts Following Bankruptcy Filing

Filing bankruptcy is not the end for your bank account; there are many options still available to you.

+ Read more

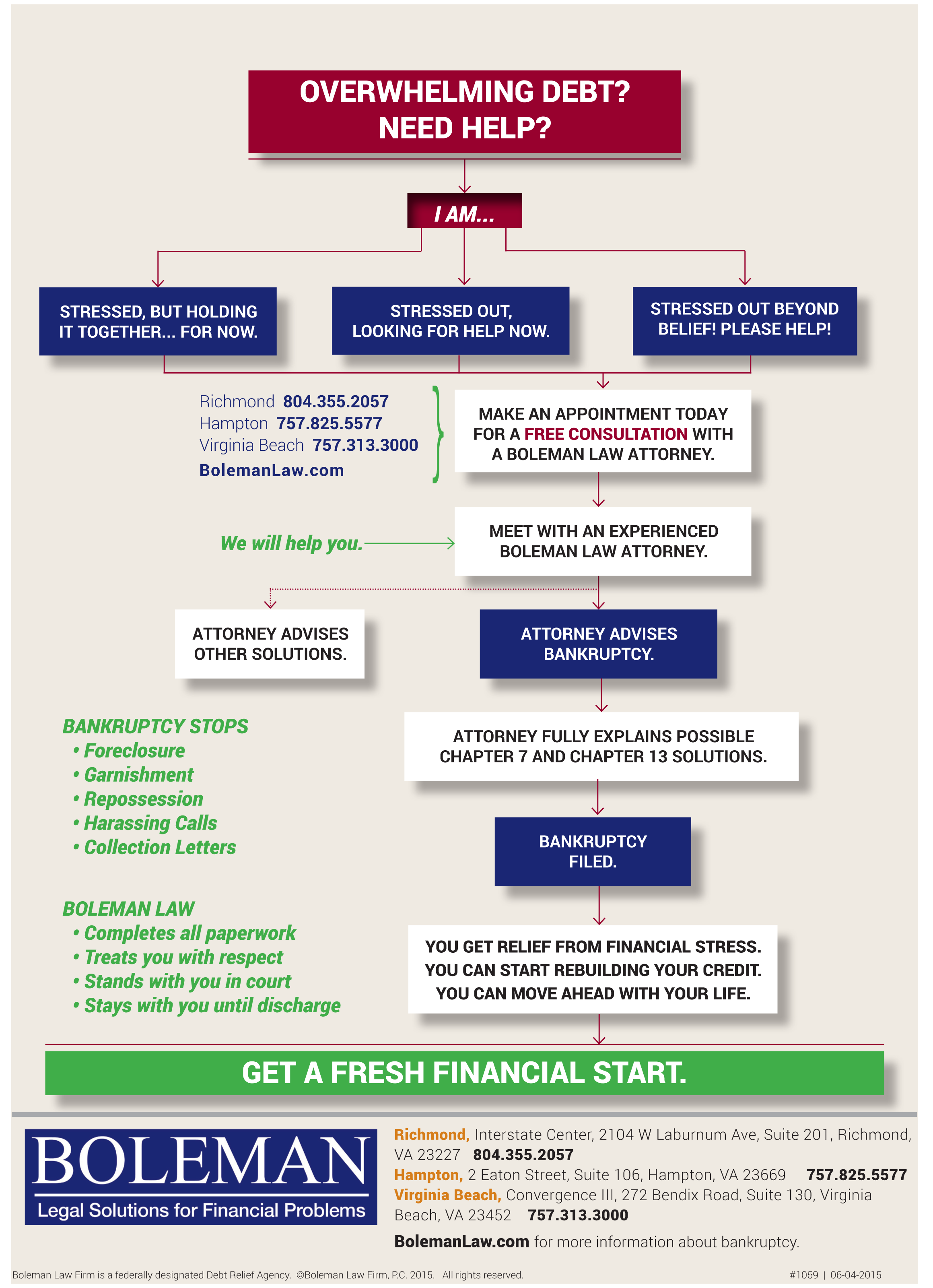

Overwhelming Debt? Need Help?

Make an appointment today for a free consultation with a Boleman Law attorney.

+ Read more

The basics of repossession.

If you fail to pay a secured creditor*, repossession is a legal process that allows that creditor to take back or repossess the property (collateral) that secures the debt.

+ Read more

Do you need to file for bankruptcy?

Though we have not met, here is what I know. You’ve worked hard, paid your bills and built up your credit rating – and then something bad happened.

+ Read more

Debtor’s Education Course is required to complete your bankruptcy.

If you do not complete the Debtor’s Education Course and obtain a Pre-Discharge Education certificate your bankruptcy discharge may be denied by the court.

+ Read more

Get straight with the IRS now.

The IRS can pounce without warning if you haven’t filed tax returns.

+ Read more

Solutions for an overwhelming mortgage payment.

The mortgage payment was OK when you bought the house. But things have changed. Job loss. Medical bills. You’ve missed some payments. Fortunately, there are solutions.

+ Read more

Successful outcomes through bankruptcy.

“Successful” depends on your perspective, but an outcome that relieves overwhelming debt and gives people a financial – and emotional – fresh start should be considered successful.

+ Read more

You can keep the shirt on your back.

Some people think that filing for bankruptcy means that you’ll lose everything – even the shirt on your back. But that’s not the case. An experienced attorney will help protect you while maintaining your rights.

+ Read more

Underwater homes: How to keep your feet dry.

Only a few short years ago, people thought of their family home as an investment that would pay valuable dividends in the future. How times have changed!

+ Read more

Six tips on interviewing a bankruptcy lawyer.

Choosing a skilled, experienced bankruptcy lawyer is essential to getting a fresh financial start.

+ Read more

The law firm that started on a door.

In 1991 Gayle and I started a bankruptcy law firm in Richmond. We had one room. We couldn’t afford a desk. So we took off an inside door, laid it across two low file cabinets and made a desk that we shared.

+ Read more

How to choose a bankruptcy lawyer.

Finding an expert bankruptcy specialist can make a huge difference when you’re working to regain your financial health.

+ Read more

We accept Group Legal Insurance plans.

Many people have group legal insurance or group legal discount plans through their work, union or other organization. Boleman Law is an approved legal network provider for most plans.

+ Read more

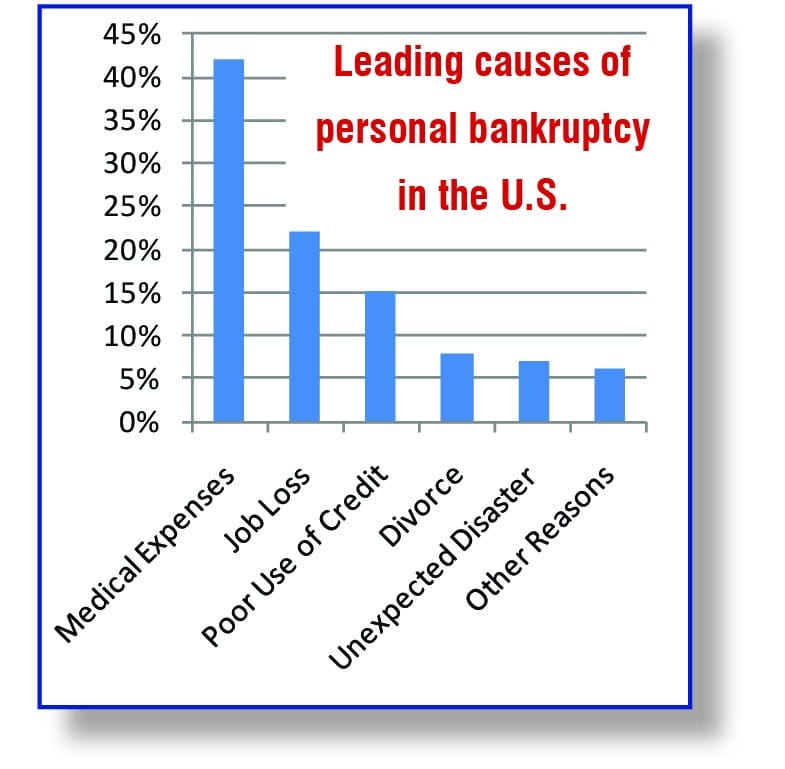

Financial problems can happen to anyone.

If you’re worried about your financial situation, don’t be embarrassed. You’re not alone. There are legal solutions. We will help you.

+ Read more

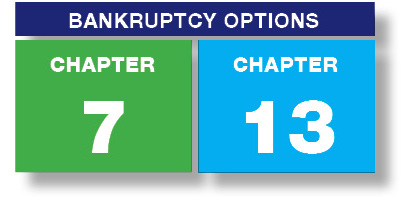

Differences: Chapter 7 and Chapter 13.

Overwhelming debt? Time for a fresh start? There are two options for filing personal bankruptcy in Virginia: Chapter 7 or Chapter 13. During your free consultation our attorneys can help you decide which option is best for your situation.

+ Read more

Stopping harassing debt collection calls.

For people facing overwhelming debt, just answering the phone or opening the mail can be stressful.

+ Read more

Creating a personal budget.

An important step in taking control of your personal finances is to create a realistic budget and stick to it.

+ Read more

Bankruptcy myths.

Bankruptcy is a mystery to many people and plenty of myths have grown up around the legal process. Here are some common misunderstandings along with the facts.

+ Read more

Bankruptcy and your government security clearance.

Military personnel and other government employees fear that filing personal bankruptcy, may negatively impact their security clearance and their jobs (even when instructed to do so by a superior to keep their security clearance). Here are some clearance investigation guidelines.

+ Read more

Preparing for cutbacks, layoffs and sequestration.

If you’re like most people, you live from paycheck to paycheck. But what happens if your paycheck is suddenly cut by 20% or disappears altogether? If you see sequestration or work cutbacks in your future, here are 10 things you can do to do to get ready.

+ Read more

Bankruptcy stops: foreclosure, repossession, garnishment, harassing calls.

People with overwhelming debt are often faced with legal consequences. Bankruptcy is legal protection that helps them get a fresh financial start.

+ Read more

©2025 Boleman Law Firm, P.C.