Debt

Credit Card Debt and General Debt Are Rising

Many Americans have been hit hard with debt and have turned to credit cards to bridge the gaps. However, now their debts are rising as their credit card payments become overwhelming.

If your credit card debt or other debt is causing financial issues for you, contact us today! Boleman Law Firm will help you!

+ Read more

The Buy Now, Pay Later Holiday Debt Hangover Has Arrived, as Consumers Wonder How They’ll Pay Bills

Many Americans who turned to buy now, pay later payment plans to fund last year’s holiday shopping and avoid credit card debt are now having trouble paying off those bills.

If buy now, pay later, payments are causing financial issues for you, contact us today! Boleman Law Firm will help you!

+ Read more

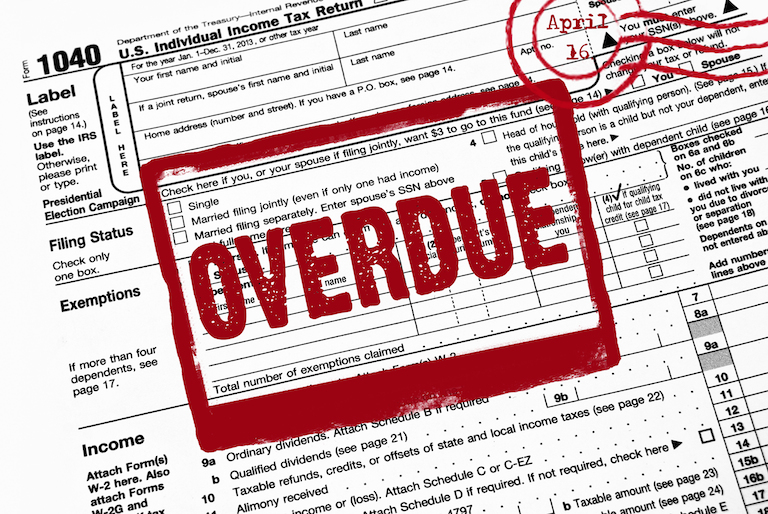

Credit Card Delinquencies Surged in 2023, Indicating ‘Financial Stress,’ New York Fed Says

Credit card delinquencies surged more than 50% in 2023 as total consumer debt swelled to $17.5 trillion, the New York Federal Reserve reported on February 6th, 2024.

Debt that has transitioned into “serious delinquency,” or 90 days or more past due, increased across multiple categories during the year, but none more so than credit cards.

Are you struggling with credit card debt? Call Boleman Law Firm, we will help you!

+ Read more

Credit Card Debt Hits a ‘Staggering’ $1.13 Trillion

Americans now owe a collective $1.13 trillion on their credit cards, according to a new report on household debt from the Federal Reserve Bank of New York. Are you struggling with credit card debt? Call Boleman Law Firm, we will help you!

+ Read more

New York Federal Reserve Report Shows Increase in Household Debt and Delinquencies

The New York Federal Reserve reported in its latest quarterly Household Debt and Credit Report that total household debt climbed by $212 billion in the fourth quarter of 2023 to $17.5 trillion. Amid the rise in debt, delinquency rates and the transition into troubled status were both higher.

The New York Fed noted that ‘serious credit card delinquencies increased across all age groups, notably with younger borrowers surpassing pre-pandemic levels.

Are you worried about your credit card debt? Call Boleman Law Firm, we will help you!

+ Read more

Don’t give Money or Information to Scammers promising Student Loan Forgiveness

Everyone should be aware of potential student loan scams. There are predatory companies and individuals seeking to capitalize on confusion over student loan repayment and forgiveness statuses. Always contact your lender directly and avoid providing personal information to unknown callers.

+ Read more

Inflation has Americans turning to Loans

Millions of folks are finding themselves stretched thin trying to pay their regular living expenses and meet their minimum monthly loan and credit card bills.

+ Read more

End of State Relief Program could start Eviction Crisis

As state relief programs expire and landlords are starting eviction processes, please be aware of your rights and options as a renter. You may have the option to pay back your rent arrears through a bankruptcy case and enable you to stay in your home.

+ Read more

Rising prices cause more Debt among Families

Consumers are paying more for everything, including the essentials, across the US. As prices rise and the median income falls, families will be greatly affected by mounting debt.

If you feel like you are drowning in debt, or your bills are piling up, you are not alone. Boleman Law will help you. We have legal solutions for your financial problems.

+ Read more

John Bollinger Discusses Concerns for Future Debt Collection with ABI

What are the concerns after the Supreme Court’s ruling in Henson v. Santander Consumer? Could it affect you? Find out what John Bollinger has to say here!

+ Read more

Payday loan business coming under close scrutiny by CFPB

The Consumer Financial Protection Bureau (CFPB) is looking into payday lending and in the next 12 to 18 months may issue guidance or propose regulations for the $46 billion business. At a CFPB hearing in Richmond last week speakers for and against payday loans were heard. Read more …http://www.richmond.com/business/sponsored-content/article_c2fa4046-d884-11e4-a4fd-5b33b58a0231.html

+ Read more

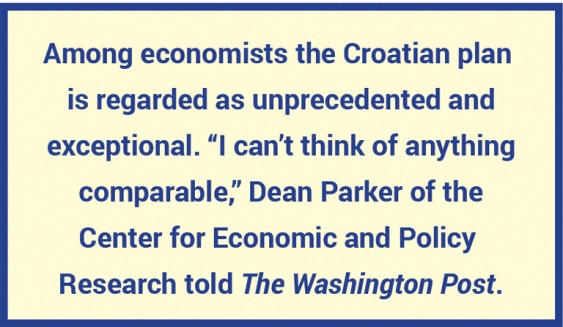

Croatia cancels the debts of 60,000 poor people.

Croatia cancels debts for 60,000 citizens. But don’t expect the same in the U.S.

+ Read more

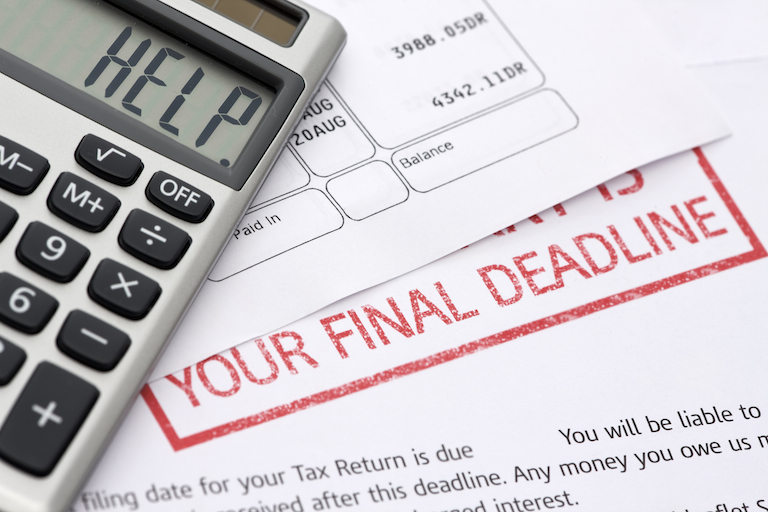

Get straight with the IRS now.

The IRS can pounce without warning if you haven’t filed tax returns.

+ Read more

Lift the burden of debt today and get your life back.

Since 1991 Boleman Law Firm has helped over 106,000 Virginians regain their financial health. They help people with financial problems such as vehicle repossession, job loss, home foreclosures, credit card debt and payday or title loans.

+ Read more

Losing sleep over your debts?

Since 1991 Boleman Law Firm has helped over 106,000 Virginians regain their financial health. They help people with financial problems such as vehicle repossession, job loss, home foreclosures, credit card debt and payday or title loans.

+ Read more

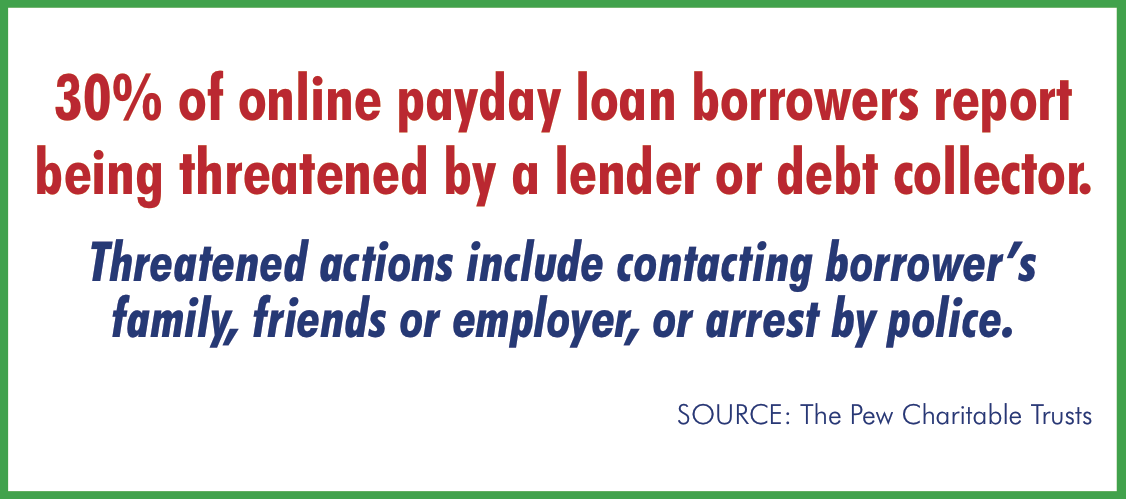

Online payday lending is a growing concern.

Our offices have been abuzz over the past couple of weeks about the recent Pew Charitable Trust report on online payday lending. Among the highlights: 650% APR is typical for lump sum online payday loans.

+ Read more

Time to get straight with the IRS.

Tax season is special. Few people enjoy it, but most somehow make the effort to file. For some the incentive is a refund. For those who have to pay, the incentive may be to prevent interest charges and fines.

+ Read more

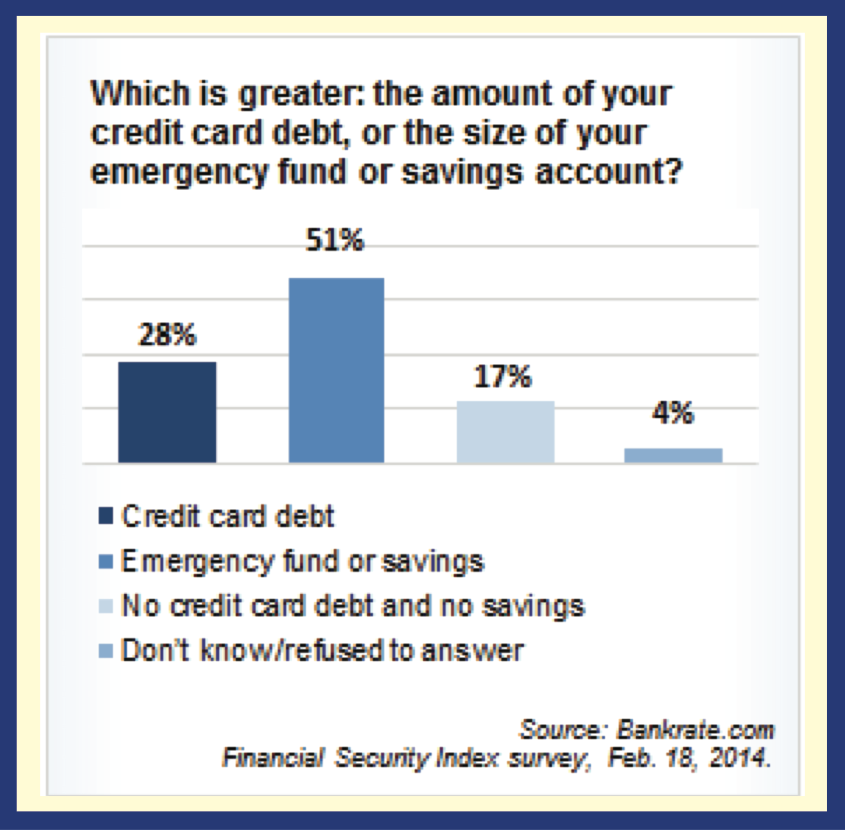

Over 25% of us aren’t ready for a financial emergency.

In America today, 28% of us have more in credit card debt than we have in savings. That’s up 5% in the past two years. Another 17% of us don’t have any credit card debt, but we don’t have any emergency savings either.

+ Read more

Many Virginians Still Struggling to Make Ends Meet.

The “dollar stores” are a good barometer of the economy.

The recent announcement from Family Dollar highlights the growing income gap between consumers who are regaining ground after the depression and those who are still stuck.

+ Read more

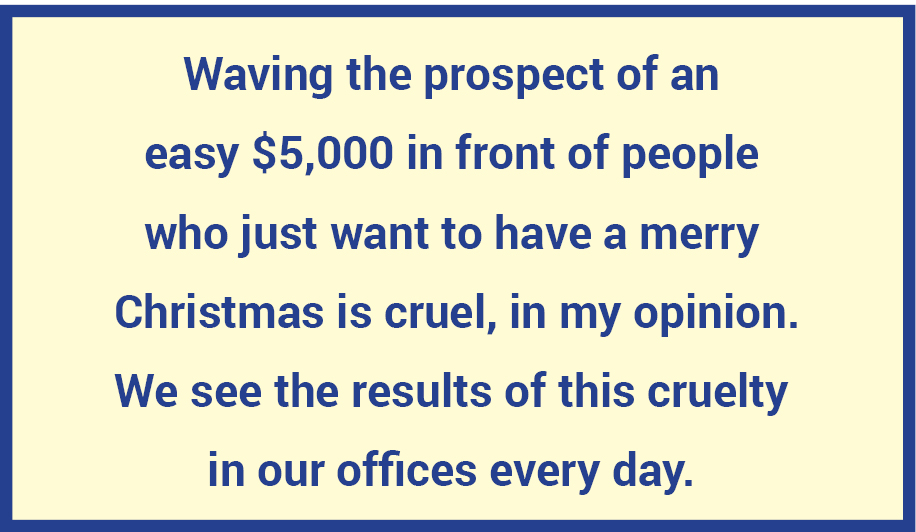

Would Santa take out a title loan against his big red sleigh?

I was watching TV a few days ago when I saw an ad that raised my blood pressure to the boiling point. It showed “Mr. and Mrs. Santa” discussing how to pay for Christmas. Mrs. Santa, in a moment of weakness, recommends taking out a title loan on their reindeer sleigh. They could get up to $5,000, she notes, without a credit check.

+ Read more

2015 could be the year for your fresh financial start.

For many of us, January is the time for our annual renewal. We acknowledge that 2014 is over, along with the problems and joys, and that 2015 is here, bright and shiny. It’s time to get healthy and get a fresh start.

+ Read more

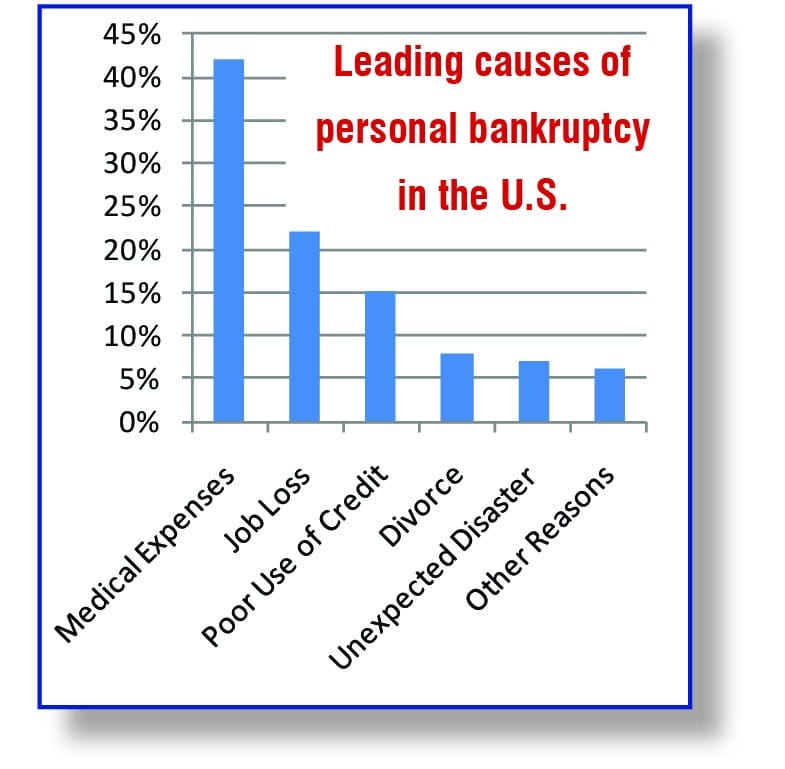

Solutions for an overwhelming mortgage payment.

The mortgage payment was OK when you bought the house. But things have changed. Job loss. Medical bills. You’ve missed some payments. Fortunately, there are solutions.

+ Read more

Eliminating Debt and Avoiding Scams

Rusty Boleman speaks on Showcase Richmond about financial scams and how to avoid them when eliminating debt.

+ Read more

Financial problems can happen to anyone.

If you’re worried about your financial situation, don’t be embarrassed. You’re not alone. There are legal solutions. We will help you.

+ Read more

Stopping harassing debt collection calls.

For people facing overwhelming debt, just answering the phone or opening the mail can be stressful.

+ Read more

Creating a personal budget.

An important step in taking control of your personal finances is to create a realistic budget and stick to it.

+ Read more

Preparing for cutbacks, layoffs and sequestration.

If you’re like most people, you live from paycheck to paycheck. But what happens if your paycheck is suddenly cut by 20% or disappears altogether? If you see sequestration or work cutbacks in your future, here are 10 things you can do to do to get ready.

+ Read more

©2025 Boleman Law Firm, P.C.